ATMs have been a convenient way for customers to access quick cash out of their accounts, but with all the ATM-related cybercrime stories, just how safe are they?

ATM scams have been around for a long time.

The latest evolution in ATM scams involve hackers using malware in Windows-based ATMs.

“The malware they are using is very effective at overcoming the ATM protections in place,” says Graham Mott, director of the U.K.’s ATM network, the LINK scheme. “We live in an international age. Crimes cross borders. Criminals are always looking for new techniques. So, it’s not the criminal who is migrating; it’s the technique that is migrating.”

The U.K. connects all of their 65,000 ATMs through LINK scheme, giving them a broad view of attacks and techniques used by hackers.

“The advantage is we are seeing all financial transactions which occur among financial institutions,” Mott says. “So it gives us a very good opportunity to see where attacks are happening and to see what the techniques are.”

Staying ahead of hackers new techniques and trying to anticipate and counter attacks is the approach companies need to take, Mott adds.

Mott will be a feature presenter at Information Security Media Group’s Fraud Summit in London on September 23.

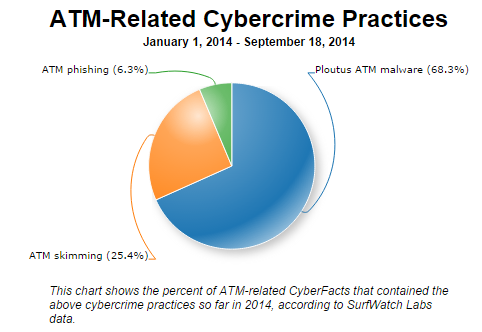

Using

malware to attack ATM machines is not a new technique being utilized by

hackers. When looking at ATM-related cybercrime practices this year,

Ploutus ATM malware is by far the most discussed.

Using

malware to attack ATM machines is not a new technique being utilized by

hackers. When looking at ATM-related cybercrime practices this year,

Ploutus ATM malware is by far the most discussed.Skimming techniques have been applied in many ATM hacks around the world. Thieves install devices on ATMs to steal card information. When an ATM has been tampered with, it can be very hard to detect.

Here are some links providing tips for ATM security:

Skimtacular: All-in-One ATM Skimmer

10 Consumer Tips for ATM Safety and Security

4 Tips to Protect You from ATM Thieves

How to Spot (and Stop) ATM Skimmers

No comments:

Post a Comment